The wave of Open Banking has hit the shore, is it a fad or a goldmine? only time will decide, I believe in the latter. It is no secret, Open banking related buzzwords have been floating on the web and some readers are left utterly confused and others misinformed with thoughts such as “my data will be exposed to other parties”, which is hardly from the truth.

The inception of open banking is directly tied in with PSD2 directive which was bought to public attention in late November 2015.

Payments Service Directive

It all started with PSD2, Payments Service Directive 2 is a European Union Directive that regulates payment services and it’s providers. PSD2’s goals were set on increasing pan-European competition and participation in the payments sector, not only limited to banks.

The directive establishes a clear and comprehensive set of rules that will apply to existing and new providers of innovative payment services. These rules seek to ensure that these players can compete on equal terms, leading to greater efficiency, choice and transparency of payment services, while strengthening consumers’ trust in a harmonised payments market. — PSD2 Summary

Open Banking

Inspired by OpenData and with PSD2 as the backbone, Open Banking was born. Open Banking is essentially an API (Application Programming Interface) that allows external regulated third parties to interact with banks in a unified fashion.

API — Set of functions and procedures that allow different systems to communicate

How it was before Open Banking?

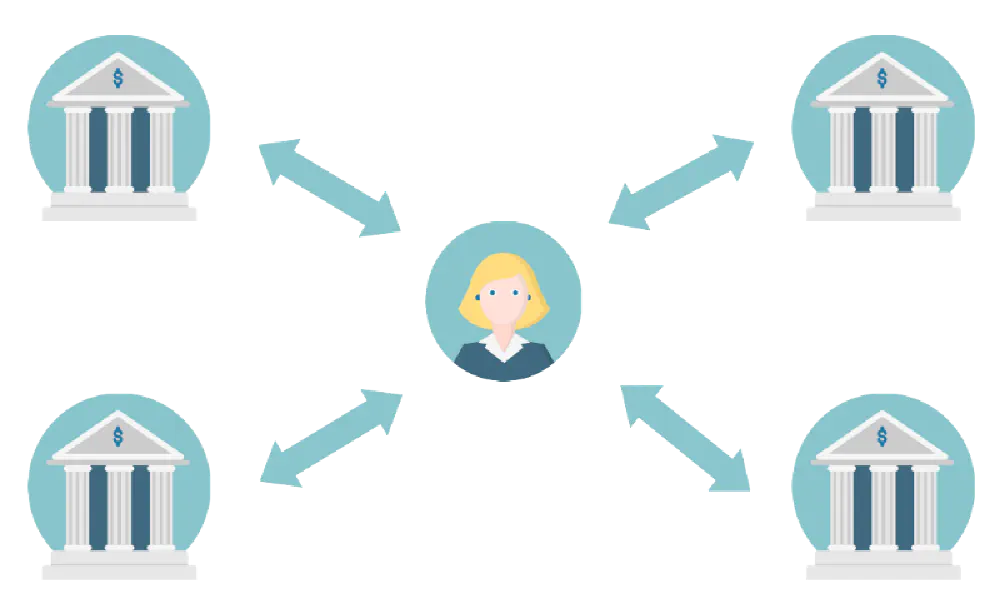

Payment services and banking was monopolized, consumers were locked into the ecosystem that individual banks provided. As for the involvement of third parties for payment services was limited therefore consumers were interacting with banks independently with the services provided.

What Open Banking enables third parties?

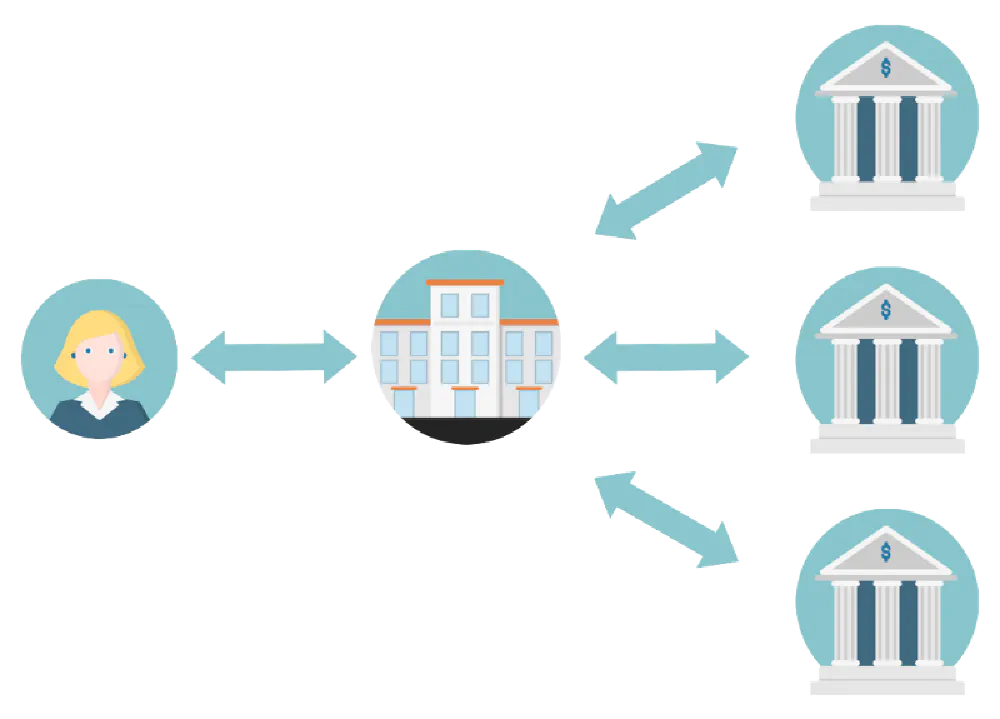

Open banking exposes financial services to third parties, these can be consumed by third parties to create applications or services for consumers.

This enables a new industry of applications that integrate with Open Banking APIs to give a new experience for consumers to provide insight into their financial data and allow easy payments.

Services provided in Open Banking can be categorized into two.

Account information services which expose account and transactional information for gaining better knowledge on a consumer’s financial status.

Payment initiation services which allow consumers to pay via credit transfers allowing goods to be released with a minimum delay.

Security and Consent

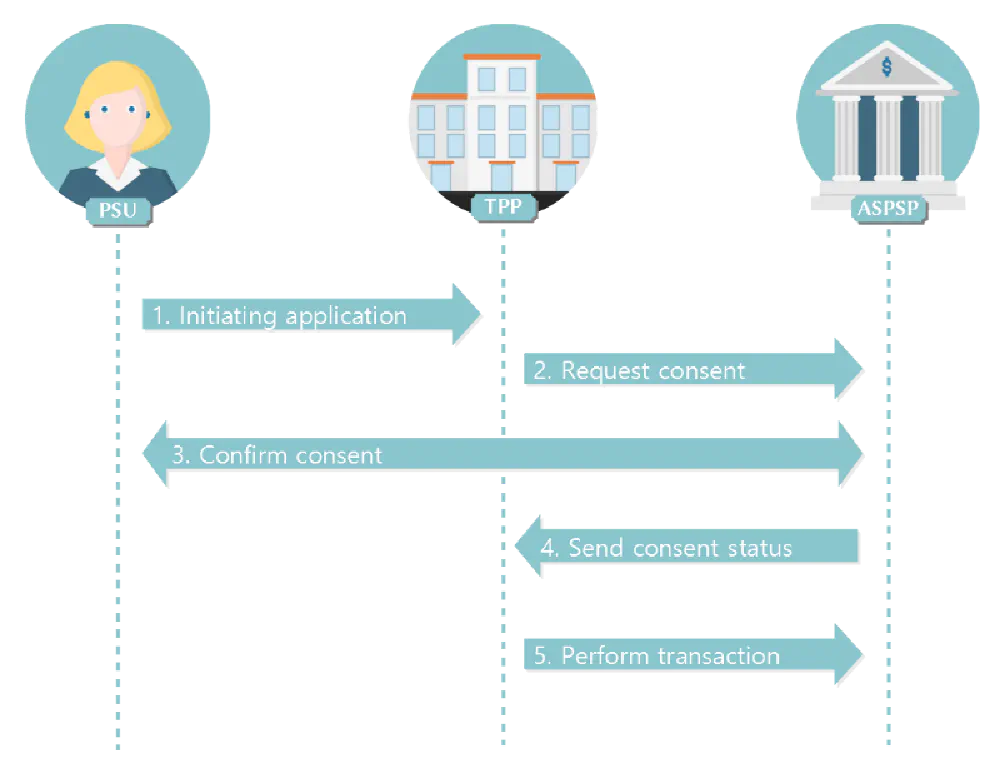

Open Banking is designed with security and consent in mind. By design, the third party providers are not able to retrieve transactions or submit payments without explicit consent from the consumer.

An example procedure is shown below. On initiation of a third party application, the third party will request consent for the transaction and the bank will confirm it with the consumer after which the transaction will take place.

Most Open Banking APIs are designed with open source methodologies where groups of people over the internet collaborate to provide ideas to make it secure as possible.